Banks

Subject: Social studies

Grade: Sixth grade

Topic: Banking And Finance

Please LOG IN to download the presentation. Access is available to registered users only.

View More Content

Introduction to Banks

– What exactly is a Bank?

– A bank is a place where people keep their money safe.

– The importance of Banks

– Banks help in managing money, giving loans, and keeping the economy stable.

– Understanding saving money

– Saving money means putting it aside for the future or emergencies.

– How Banks keep money safe

– Banks use vaults and digital security to protect our money.

|

Begin the lesson by explaining that a bank is an institution where people can save and borrow money. Emphasize the role of banks in the economy and how they help people manage their finances. Discuss the concept of saving money, why it’s important for future needs or unexpected situations, and how banks can help grow savings through interest. Highlight the security measures banks use to ensure that people’s money is kept safe. Encourage students to think about why they might want to save money and how banks could help them achieve their financial goals.

The Evolution of Banking

– From barter to banks

– Early trade relied on barter; money created a need for banks.

– Banking through the ages

– Banks began in ancient times, evolving with commerce and technology.

– Banks’ role in economies

– Banks manage money, provide loans, and support economic growth.

– Modern banking functions

|

This slide provides a historical overview of banking, starting from the barter system to the establishment of modern banks. Discuss how the invention of money led to the need for safekeeping and lending services, which were the precursors to banks. Highlight key developments in banking from ancient times to the present, such as the introduction of checking accounts, banknotes, and digital banking. Emphasize the critical role banks play in the economy by managing resources, providing loans to businesses and individuals, and facilitating transactions. Use examples like the Medici Bank of the Renaissance to illustrate the evolution. Encourage students to think about how banking affects their daily lives and the broader economy.

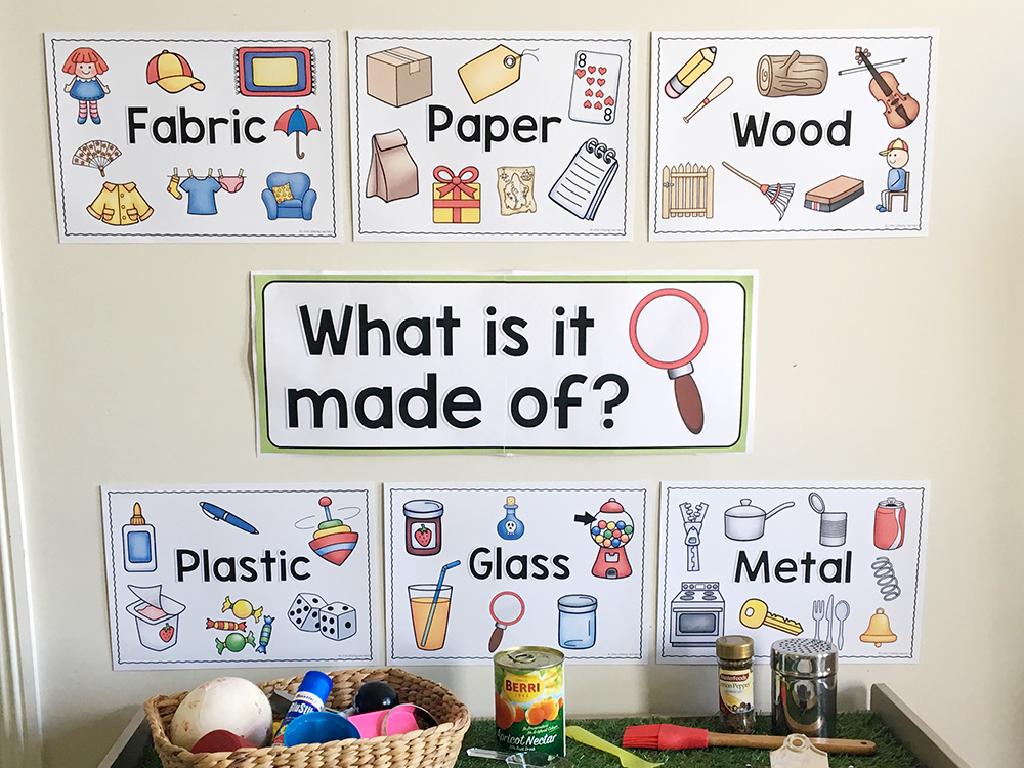

Types of Banks

– Commercial Banks

– Serve individuals and businesses, offer loans, deposits, and investments

– Credit Unions

– Member-owned institutions offering similar services to banks

– Online Banks

– Operate on the internet, no physical branches

– Savings & Loan Associations

– Specialize in savings accounts and real estate loans

|

This slide introduces students to the different types of banks and their primary functions. Commercial banks cater to the general public and businesses, providing a wide range of financial services including loans, deposits, and investment services. Credit unions are cooperative institutions owned by their members, offering similar services to commercial banks but often with more favorable rates. Online banks operate exclusively on the internet, which allows them to offer services with lower fees. Savings and Loan Associations focus on savings accounts and providing loans for real estate. Encourage students to think about which type of bank their family might use and why. Discuss the importance of each type of bank in our economy and how they cater to different needs.

How Banks Work

– Banks protect your money

– Banks use vaults, guards, and technology to keep deposits secure.

– Interest: Earning on savings

– Interest is money earned from keeping savings in a bank account.

– Banks give loans and mortgages

– Loans are borrowed money to be paid back with interest; mortgages are loans for buying property.

– Understanding bank lending

|

This slide aims to explain the basic functions of banks to sixth-grade students. Start by discussing how banks are responsible for keeping money safe through various security measures. Then, introduce the concept of interest, explaining that it’s the money people earn as a reward for keeping their savings in a bank. Next, describe loans and mortgages, emphasizing that banks can lend money for various purposes, including buying homes, which must be paid back with additional money called interest. Use relatable examples to help students understand these concepts, such as comparing a bank to a piggy bank that adds extra coins as a reward over time.

Exploring Bank Services

– Overview of bank services

– ATMs and their convenience

– ATMs allow cash withdrawal and account management 24/7.

– Credit cards: use and responsibility

– Credit cards enable purchases on credit, to be paid back later.

– Online banking features

– Online banking provides easy access to accounts from anywhere.

|

This slide introduces students to the various services provided by banks, such as ATMs, credit cards, and online banking. Emphasize the importance of each service in everyday life. ATMs offer convenience by allowing people to withdraw cash and manage their accounts at any time. Credit cards give the flexibility to make purchases even when one does not have immediate funds, highlighting the importance of using them responsibly. Online banking has revolutionized how we access and manage our finances, offering the ability to perform transactions, check balances, and more from the comfort of our homes or on the go. Encourage students to discuss how these services impact their family’s daily financial activities and the responsibility that comes with using them.

Opening and Managing a Bank Account

– Steps to open a bank account

– Choose a bank, provide personal info, and make an initial deposit.

– Managing your account responsibly

– Keep track of your spending and make regular deposits.

– Reading and understanding bank statements

– Monthly statements show account activity: deposits, withdrawals, fees.

|

This slide aims to educate sixth-grade students on the basics of opening and managing a bank account. Start by discussing the steps to open an account, including choosing a bank, providing necessary personal information, and making an initial deposit. Emphasize the importance of managing the account responsibly by monitoring spending, avoiding overdrafts, and saving regularly. Explain how to read a bank statement, which is a monthly summary of account activity, including any deposits, withdrawals, and fees. Use examples relevant to their understanding, such as saving allowance money or birthday cash gifts. Encourage questions to ensure comprehension.

The Role of Banks in Our Community

– Banks as pillars of the community

– Banks are not just for money; they’re part of our daily lives.

– Banks’ role in local development

– They provide loans for homes and businesses, boosting the economy.

– Community programs by banks

– Banks often sponsor scholarships, events, and financial literacy programs.

– Understanding banks’ community impact

|

This slide aims to educate sixth-grade students on the integral role banks play within their communities beyond just handling money. Banks are seen as pillars that support local economies by providing loans for homes and businesses, which in turn stimulates economic growth. Additionally, banks often give back to the community through sponsorship of various programs such as scholarships for education, events that bring people together, and initiatives to improve financial literacy among citizens. Encourage students to think about and discuss how their local banks are involved in their community and the positive effects of these contributions.

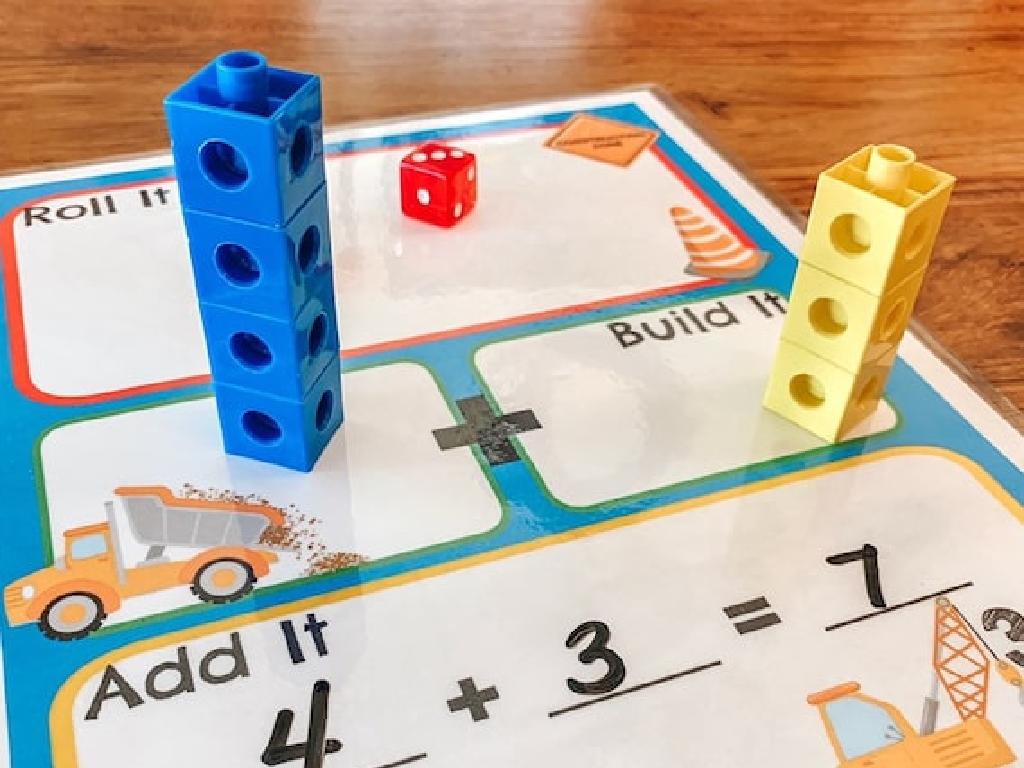

Class Activity: Bank Simulation

– Role-play as bankers and customers

– Practice opening an account

– Simulate the process of how to start a bank account

– Conduct banking transactions

– Deposit, withdraw, and transfer money in simulations

– Learn bank responsibilities

– Explore duties of tellers and customer etiquette

|

This interactive class activity is designed to give students a practical understanding of how banks operate. Divide the class into two groups: one will act as bank employees, and the other as customers. Bank employees will guide customers through the process of opening an account, including filling out forms and explaining the types of accounts. Customers will then engage in transactions such as deposits, withdrawals, and transfers, with ‘play money’ to simulate real banking activities. Discuss the importance of accuracy and customer service in banking. Rotate roles to ensure all students experience both sides. Possible activities: 1) Opening a savings account, 2) Requesting a loan, 3) Using an ATM, 4) Discussing account types, 5) Resolving a fictional account error.