Banks

Subject: Social studies

Grade: Seventh grade

Topic: Banking And Finance

Please LOG IN to download the presentation. Access is available to registered users only.

View More Content

Introduction to Banks

– What exactly is a Bank?

– A bank is a financial institution that accepts deposits and offers loans.

– The role of Banks in society

– Banks keep money safe, help manage finances, and support economic growth.

– Overview of Banking and Finance

– Today, we’ll explore how banks operate and their impact on the economy.

– Significance in everyday life

– Understanding banks helps us make informed financial decisions.

|

Begin the lesson by defining a bank and discussing its basic functions. Emphasize the importance of banks in safeguarding money, providing loans, and facilitating transactions. Explain how banks contribute to the overall economic stability and growth by supporting businesses and individuals. The overview of today’s lesson should include the role of banks in finance, how interest works, and the different types of banking services available. Highlight the relevance of understanding banking concepts for personal financial literacy. Engage students by asking them about their experiences with banks or bank-related transactions they are familiar with.

The History of Banking

– Origins of banking

– Bartering goods to storing value in banks

– Evolution of banking services

– From simple loans to complex financial services

– The world’s first banks

– Ancient Mesopotamia and Greece established first banking systems

– Modern banking transformation

– Introduction of digital banking and global financial networks

|

This slide provides a historical overview of banking, tracing its roots from the earliest forms of bartering to the sophisticated financial institutions we see today. Discuss the transition from trading goods directly to the creation of banks for storing value. Highlight how banking services have expanded from basic loans to a wide array of financial offerings. Introduce students to the first banks in ancient civilizations and how they laid the groundwork for today’s banking systems. Emphasize the significant changes brought about by digital technology, leading to the modern era of online banking and global finance. Encourage students to think about how banking has impacted economic development and daily life throughout history.

Types of Banks

– Commercial Banks and their roles

– Handle deposits, loans, and basic financial services

– Savings and Loan Associations

– Specialize in savings accounts and mortgage loans

– Credit Unions vs. Other Banks

– Member-owned institutions offering favorable rates

– Online Banks: Banking in the Digital Age

– Provide banking services exclusively online

|

This slide introduces students to the different types of banks and their primary functions. Commercial banks are the most common type, providing a wide range of services including deposits, loans, and other financial transactions. Savings and Loan Associations focus on savings accounts and providing loans, particularly for mortgages. Credit Unions are member-owned and often offer better interest rates and more personalized service. Online Banks represent the modern evolution of banking, operating without physical branches and offering services through digital platforms. Encourage students to think about the different services they or their families use and which type of bank might provide them. Discuss the pros and cons of each type of bank, including convenience, customer service, and interest rates.

How Banks Work: An Overview

– Banks’ role in the economy

– Banks help manage money, giving loans and keeping deposits safe.

– Understanding deposits and loans

– People save money (deposits); banks lend it out (loans).

– Interest rates simplified

– Interest: fee for borrowing money or reward for saving.

– Steps to open a bank account

– We’ll learn the process and documents needed.

|

This slide introduces students to the fundamental concepts of how banks function within the economy. It covers the role of banks in managing the financial resources of individuals and businesses, explaining how deposits and loans work, and the concept of interest rates as the cost of borrowing or the benefit of saving money. Additionally, the slide will outline the basic steps and requirements for opening a bank account, which is a practical skill for students. The teacher should provide real-life examples, such as comparing banks to a piggy bank that can lend out money, to make the concepts relatable and easier to understand.

Understanding Bank Services

– Checking vs. Savings Accounts

– Checking for daily use, savings for future.

– Certificates of Deposit (CDs)

– CDs: Save money with fixed interest rates.

– Credit vs. Debit Cards

– Credit cards borrow money, debit cards use your funds.

– Online Banking Services

– Manage accounts anytime, anywhere via internet.

|

This slide aims to introduce students to the various services offered by banks. Checking accounts are typically used for daily transactions, while savings accounts are for setting aside money for the future. Certificates of Deposit (CDs) are savings tools with a fixed interest rate and maturity date, offering benefits like higher interest rates compared to regular savings accounts. It’s crucial to explain the difference between credit cards, which allow you to borrow money up to a certain limit, and debit cards, which deduct money directly from your checking account. Lastly, online banking services provide convenience by allowing customers to manage their finances from their computers or smartphones. Encourage students to discuss with their parents about these services and how they are used in their households.

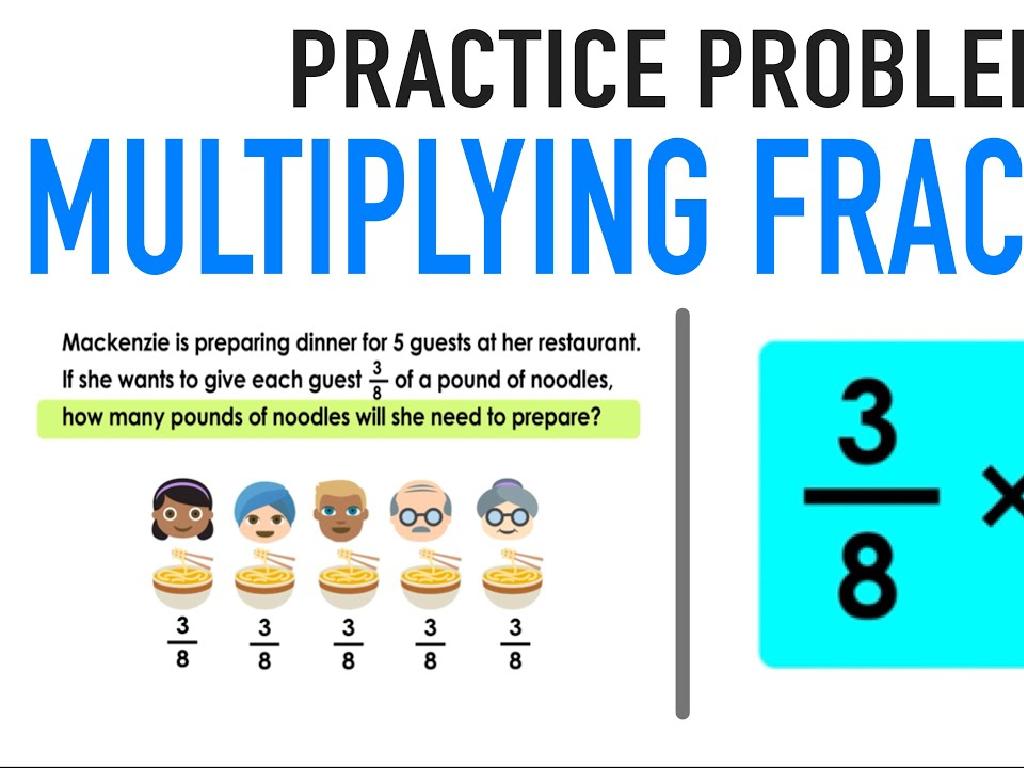

Understanding Interest in Banking

– What is interest?

– Payment for the use of borrowed money over time.

– Calculating interest

– Interest = Principal x Rate x Time for simple interest.

– Simple vs. Compound Interest

– Simple interest is on initial amount, compound is on accumulated balance.

– Interest in daily banking

– Savings accounts earn interest, loans charge interest.

|

Interest is a fundamental concept in banking and finance, representing the cost of borrowing money or the benefit of saving money. It is important for students to understand how interest is calculated, as it affects everyday banking activities such as saving and borrowing. Simple interest is calculated on the original principal only, while compound interest is calculated on the principal plus any accumulated interest. Provide examples such as the interest earned on a savings account or the interest paid on a loan to illustrate these concepts. Encourage students to explore how different interest rates and time periods can impact the total amount of interest. This will help them make informed decisions in their future financial activities.

The Importance of Saving Money

– Understanding why saving is key

– How banks facilitate savings

– Banks offer accounts that keep your money safe and earn interest.

– Setting your financial goals

– Goals like buying a bike, or saving for college.

– Steps to achieve your goals

– Create a savings plan, be consistent, and monitor progress.

|

This slide aims to educate students on the fundamental concept of saving money and its significance for financial security and achieving personal goals. Begin by discussing the importance of saving money, not just for large purchases, but also as a safety net for unexpected expenses. Explain how banks can help in saving money by offering various types of savings accounts that can earn interest over time. Encourage students to think about what they might want to save for and guide them in setting realistic financial goals. Finally, provide them with a basic framework for achieving their goals, such as making a savings plan, sticking to it, and keeping track of their progress. This will help instill a sense of financial responsibility and planning from a young age.

Safety and Security in Banking

– Banks’ methods to protect money

– Banks use encryption, secure networks, and monitoring to safeguard funds.

– Role of FDIC insurance

– FDIC insurance covers up to $250,000 per depositor, per bank, for each account ownership category.

– Tips for safe online banking

– Use strong passwords, enable two-factor authentication, and log out after sessions.

|

This slide aims to educate students on the various measures banks take to ensure the safety and security of their customers’ money. Discuss how banks use advanced technology and constant surveillance to prevent unauthorized access to accounts. Explain the concept of FDIC insurance, which protects depositors’ money up to a certain limit if the bank fails. Emphasize the importance of practicing safe online banking by using strong, unique passwords, enabling additional security features like two-factor authentication, and being cautious with public Wi-Fi. Encourage students to ask questions and share any personal safe banking practices they or their families follow.

Class Activity: Creating a Savings Plan

– Discuss your savings goal

– Determine total savings needed

– Calculate monthly savings

– How much to save monthly to meet your goal in a year?

– Present your savings plan

– Share your plan with the class and explain your strategy

|

This activity is designed to teach students the practical application of saving money and financial planning. Start by having each student think about a realistic goal they would like to save for, such as a new bicycle, video game, or a gift for a family member. Then, guide them to calculate the total amount of money they would need to save. Once they have a total, help them break it down into monthly savings by dividing the total by the number of months they plan to save. Encourage students to consider their sources of income, like allowances or birthday money. Finally, have each student present their savings plan to the class, explaining their goal, the total amount needed, and their monthly savings strategy. This will help them practice public speaking and allow them to learn from each other’s saving strategies. Provide additional activity options such as creating a savings chart, researching savings accounts for kids, or learning about interest rates.