Percent Of A Number: Tax, Discount, And More

Subject: Math

Grade: Seventh grade

Topic: Consumer Math

Please LOG IN to download the presentation. Access is available to registered users only.

View More Content

Understanding Percent in Consumer Math

– Percentages in daily life

– Prices, statistics, and sports scores all use percent

– Consumer math as a skill

– Managing finances and making informed purchases

– Calculating tax and discount

– Find the percent of a price to calculate tax added or discount subtracted

– Applying percent to real scenarios

– How much is 8% tax on a $50 game or 20% off a $70 jacket?

|

This slide introduces the concept of percentages in the context of consumer math, highlighting its relevance in everyday life. Emphasize that understanding percentages is crucial for personal finance management, such as calculating taxes on purchases or determining discounts during sales. Provide examples of how to calculate the percent of a number, which is a foundational skill in consumer math. Encourage students to think of situations where they have encountered percentages, such as in shopping or when looking at their grades. The goal is to show the practical application of math in their daily lives and prepare them for the activities ahead, where they will practice calculating tax and discounts on various items.

Understanding Percentages

– Percent: A part of a whole

– Percent means per hundred, like 25% is 25 out of 100

– Percent, fractions, and decimals

– 50% is 1/2 or 0.5; they all represent the same amount

– Percent in everyday life

– Used in sales, statistics, and finance, like 30% off items or 15% tax rate

– Calculating discounts and tax

– Find the sale price by calculating 20% of $50, or add tax by finding 8% of $100

|

This slide introduces the concept of percent as a fundamental part of consumer math. Begin by defining percent as a representation of a part of a whole, specifically per hundred. Illustrate the relationship between percentages, fractions, and decimals to show different ways of expressing the same value. Provide real-life examples where percentages are commonly used, such as in calculating sales discounts or determining the tax added to a purchase. Teach students how to convert percentages into decimals for calculation purposes and practice with real-world examples, such as finding the final price of an item after a discount or calculating the tax on a bill.

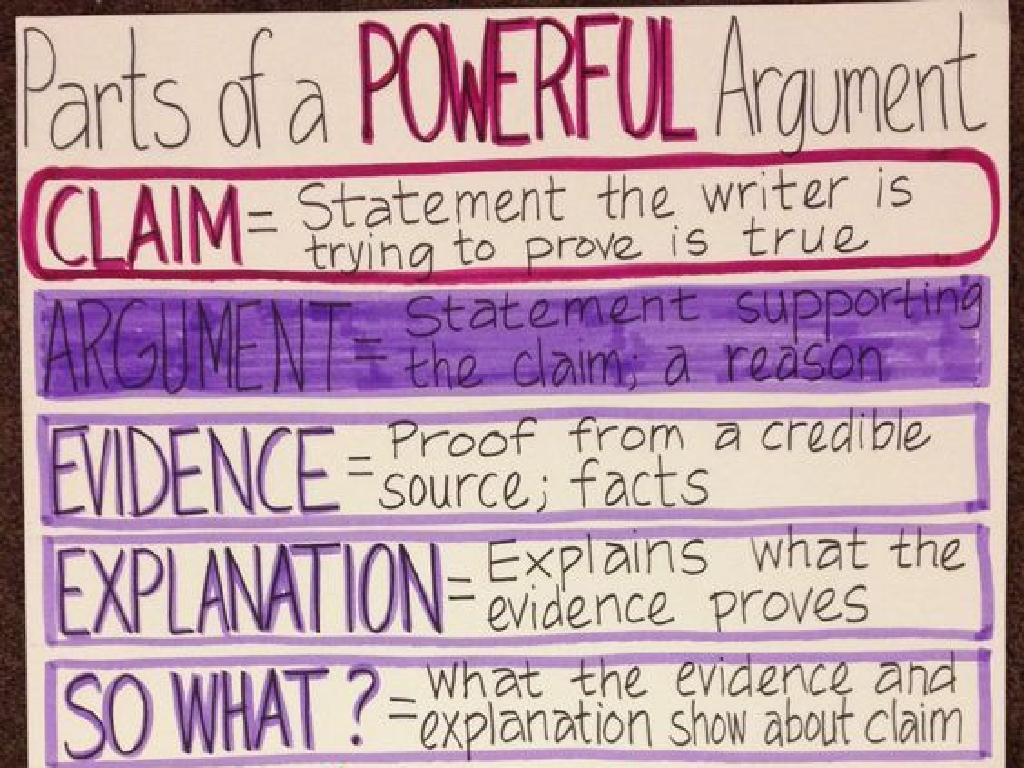

Calculating Percent of a Number

– Understand the basic formula

– Percent x Base = Amount is used to find the percent of a number

– Convert percent to decimal

– To calculate, convert the percent to a decimal by dividing by 100

– Calculate percent of a number

– Use the formula with the decimal form of the percent

– Example: Finding 20% of $50

– 20% as a decimal is 0.20; 0.20 x $50 = $10

|

This slide introduces the fundamental concept of calculating the percent of a number, which is a crucial skill in consumer math. Start by explaining the formula Percent x Base = Amount, where ‘Percent’ is the percentage you want to find, ‘Base’ is the whole number you’re finding the percentage of, and ‘Amount’ is the result. Emphasize the importance of converting percentages to decimals for calculation purposes, which is done by dividing the percentage by 100. For example, to find 20% of $50, convert 20% to 0.20 and multiply by $50 to get $10. This concept is widely applicable in real-life scenarios such as calculating taxes, discounts, and interest rates. Encourage students to practice with different percentages and base numbers to solidify their understanding.

Understanding Sales Tax

– What is sales tax?

– A percentage of the sale price, collected by retailers for the government.

– Calculating sales tax

– Multiply the item cost by the tax rate to find the tax amount.

– Example: Tax on $100 purchase

– If tax rate is 8%, tax on $100 is $8. Total cost becomes $108.

– Why sales tax is important

|

This slide introduces the concept of sales tax to students, explaining its purpose as a government levy on the sale of goods and services. Emphasize that sales tax varies by state and is added to the advertised price of items. When calculating sales tax, students should understand how to convert the percentage to a decimal and then multiply by the item’s cost. Use the $100 example to illustrate this calculation, assuming an 8% tax rate for simplicity. Discuss the role of sales tax in society and how it contributes to public services. For the class activity, have students calculate sales tax on various items with different tax rates to reinforce the concept.

Finding Discounts: Calculating Savings

– What is a discount?

– A reduction on the original price of an item.

– How to calculate percent off

– Multiply the original price by the discount rate.

– Example: 25% discount calculation

– Original price $40, with 25% off, what’s the sale price?

– Determining sale price

– Subtract the discount from the original price to find the sale price.

|

This slide introduces the concept of discounts, a fundamental aspect of consumer math. Start by defining a discount as a decrease in the original price, often used to encourage sales. Explain the process of calculating the discount by multiplying the original price by the percentage of the discount. Use an example, such as an item originally priced at $40 with a 25% discount, to illustrate the calculation. Show students how to find the final sale price by subtracting the discount amount from the original price. Encourage students to practice with different percentages and original prices to solidify their understanding. Provide additional examples and practice problems to ensure students are comfortable with the concept.

More Applications of Percent

– Understanding interest rates

– Interest is the cost of using someone else’s money. For example, banks pay you interest for keeping your money in a savings account.

– Calculating percent increase/decrease

– Percent increase: price hikes; Percent decrease: sales. For example, a 10% increase on a $50 item makes it $55.

– Figuring out tips at restaurants

– Tips are a percentage of the total bill. For example, a 15% tip on a $20 meal is $3.

– Practical uses of percent in daily life

|

This slide aims to show students the practical applications of percentages in everyday life. Interest rates affect how much money they can earn from savings accounts. Understanding percent increase and decrease is crucial for managing money during shopping, as they will encounter sales and price increases. Tips in restaurants are a direct application of percentage calculation, and it’s a social norm they will encounter. Encourage students to bring examples from their experiences or their family’s experiences with percentages. Provide additional examples, such as calculating discounts or tax on purchases, to solidify their understanding.

Calculating Percent in Consumer Math

– Calculate total cost with tax

– Add tax percentage to the original price to find total cost

– Determine sale price after discount

– Subtract discount percentage from original price for sale price

– Find final price with multiple discounts

– Apply successive discounts to the item’s price sequentially

|

This slide presents practical problems for students to apply their knowledge of percentages in real-world consumer math scenarios. For the first problem, students will add a given tax percentage to an item’s original price to find the total cost. In the second problem, they will calculate the sale price of an item after applying a discount percentage. The third problem is more complex, requiring students to find the final price after applying multiple discounts in sequence. Encourage students to show their work step by step and to understand the importance of order in applying successive discounts. These exercises will help solidify their understanding of percentages and prepare them for managing real-life financial situations.

Class Activity: Role-Play Shopping

– Pair up: Shopper & Cashier roles

– Engage in buying & selling items

– Calculate tax and discounts

– For example, if an item costs $10 and tax is 5%, how much is the tax?

– Discuss and reflect on the activity

– Share your experience and what you’ve learned about consumer math

|

This interactive class activity is designed to help students understand the practical application of percentages in consumer math. By role-playing as shoppers and cashiers, students will use play money to simulate real-life shopping experiences. They will practice applying tax and discounts to their transactions, which will reinforce their understanding of how percentages work in everyday situations. After the activity, students will reflect on their experience and discuss what they’ve learned. This will help them consolidate their knowledge and understand the importance of math in daily life. Possible activities include calculating tax for different states, applying a store-wide discount, or comparing final prices with and without discounts.

Wrapping Up: Percent Applications

– Recap: Percent in Consumer Math

– Significance of Taxes & Discounts

– Grasping taxes and discounts is crucial for real-life financial literacy.

– Homework: Percent Worksheet

– Worksheet includes problems on calculating tax, discounts, and more.

– Prepare for next class discussion

|

As we conclude today’s lesson on the percent of a number in consumer math, it’s important to emphasize the real-world applications of what we’ve learned. Understanding how to calculate taxes and discounts is essential for financial literacy and will be beneficial in students’ daily lives. For homework, students are assigned a worksheet that includes a variety of problems to apply their knowledge on calculating the percent of a number, including tax, discounts, and other consumer math scenarios. Encourage students to attempt all problems and be ready to discuss their solutions and any challenges faced in the next class. This practice will reinforce their understanding and prepare them for more complex consumer math tasks.