Simple Interest

Subject: Math

Grade: Sixth grade

Topic: Consumer Math

Please LOG IN to download the presentation. Access is available to registered users only.

View More Content

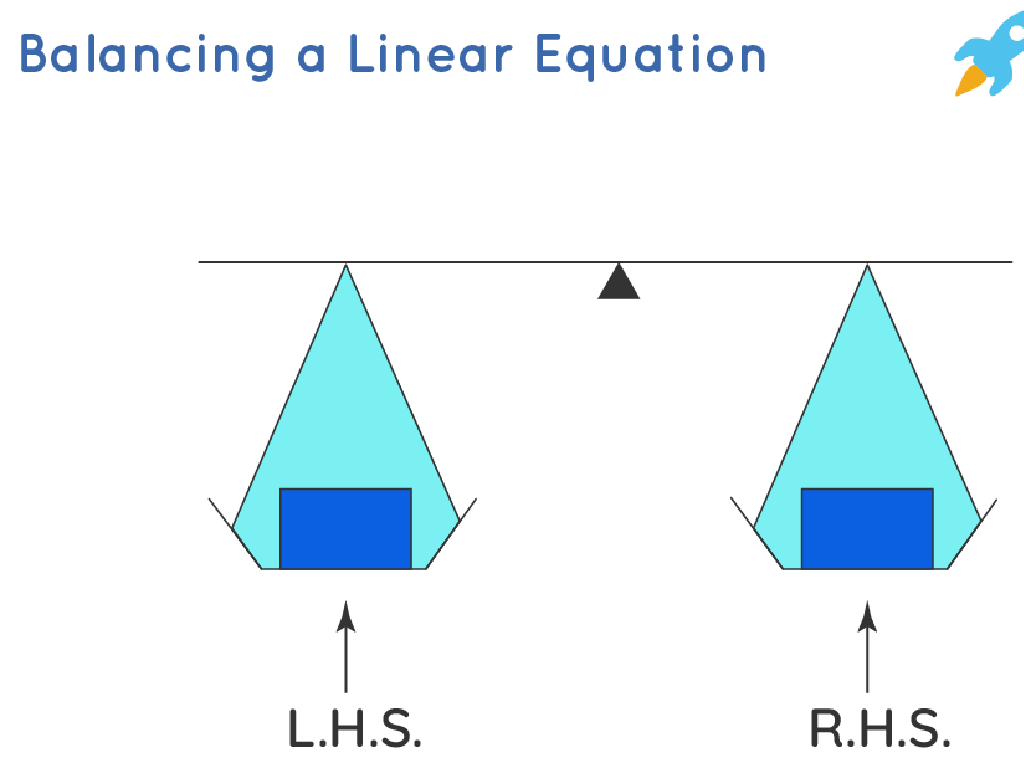

Understanding Simple Interest in Consumer Math

– What is Consumer Math?

– Defining Simple Interest

– Simple Interest is interest earned on the original amount of money invested or borrowed.

– Importance of Simple Interest

– Knowing Simple Interest helps in making informed financial decisions.

– Real-world application

– Examples: Savings accounts, loans, and investments.

|

Consumer Math involves the practical application of mathematical skills to everyday life, particularly in financial matters such as budgeting, investing, and shopping. Today’s focus is on Simple Interest, a fundamental concept in finance that calculates interest on the initial amount of money. Understanding Simple Interest is crucial for students as it lays the groundwork for future financial literacy, enabling them to calculate the cost of loans or the growth of savings over time. Use real-world examples like the interest from a savings account or a loan to illustrate how Simple Interest affects their or their family’s finances. Encourage students to think of questions or scenarios where they might need to use Simple Interest.

Understanding Simple Interest

– Define Simple Interest

– Interest earned on the original amount of money invested or borrowed.

– Learn the formula: I = PRT

– I is interest, P is principal, R is rate, T is time in years.

– Understand Principal (P)

– Principal is the initial amount of money before interest.

– Grasp Rate (R) and Time (T)

– Rate is the percentage of interest per year. Time is how long the money is invested or borrowed.

|

Simple interest is a fundamental concept in consumer math where interest is calculated only on the principal amount, or the initial sum of money. The formula I = PRT is a straightforward way to calculate this interest. Principal (P) represents the original sum of money invested or borrowed. Rate (R) is the annual interest rate, and it is usually expressed as a percentage. Time (T) is the period for which the money is invested or borrowed, typically in years. Ensure students understand each component of the formula and how they interact. Provide examples with different principals, rates, and time periods to illustrate how simple interest is computed in real-life scenarios.

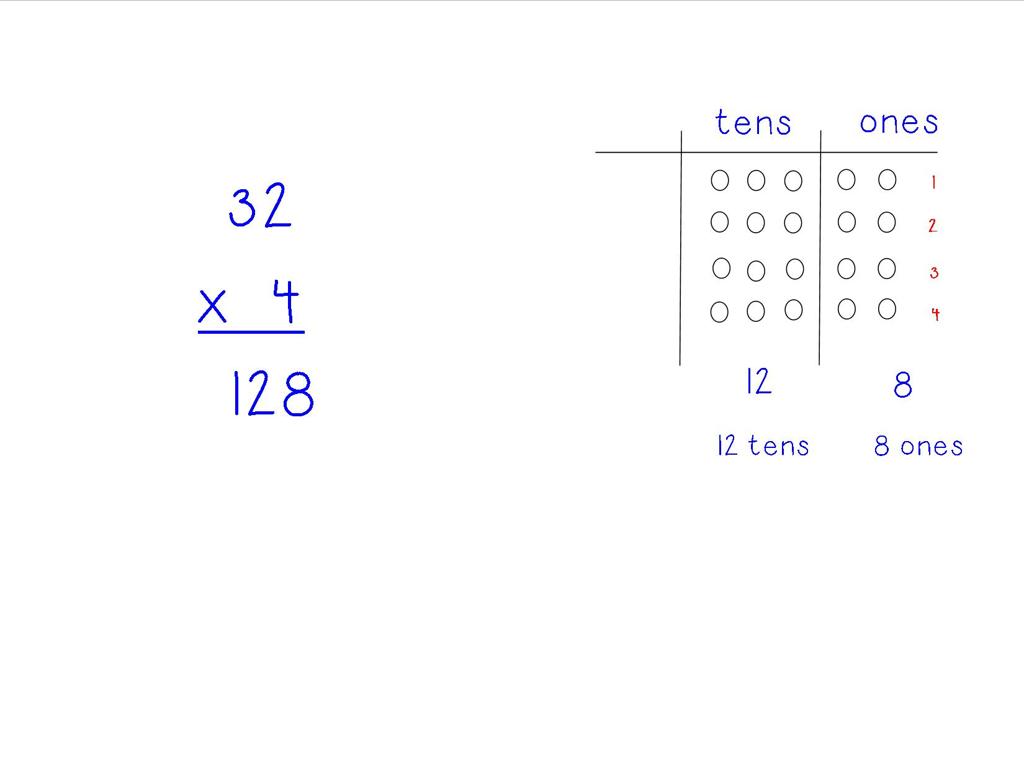

Calculating Simple Interest

– Understanding the formula I = PRT

– I = Interest, P = Principal, R = Rate, T = Time

– Example: Interest on savings

– If $1000 is saved at 3% interest, how much is the interest after 1 year?

– Practice Problem: $500 at 5% for 1 year

– Calculate the interest earned on $500 at a 5% annual rate after 1 year.

|

Introduce the concept of simple interest as a way to calculate the amount of interest earned on a sum of money over a certain period. Explain the formula I = PRT, where ‘I’ stands for the interest earned, ‘P’ is the principal amount (initial amount of money), ‘R’ is the annual interest rate (in decimal form), and ‘T’ is the time the money is invested or borrowed for, in years. Use an example of a savings account to show how interest is calculated in real life. Provide a practice problem for students to apply the formula, reinforcing the concept. This will help students understand how interest is computed and its relevance to everyday financial decisions.

Real-Life Applications of Simple Interest

– Simple Interest in Banking

– Banks pay interest on savings based on time & rate

– Loans & Mortgages

– Fixed interest for the life of the loan helps predict payments

– Simple Interest in Purchases

– Interest added to financed items like electronics

– Understanding Interest Impact

– Knowing how interest works saves money over time

|

This slide aims to show students how simple interest is applied in real-world scenarios, particularly in financial contexts that they or their families might encounter. Simple interest in banking refers to the amount earned on savings accounts. When discussing loans and mortgages, emphasize that simple interest allows for consistent payment amounts over time, making budgeting easier. For everyday purchases, explain how interest can increase the total cost of items bought on credit. Lastly, stress the importance of understanding how interest works to make informed decisions and avoid unnecessary expenses. Provide examples such as calculating interest on a savings account or the total cost of a loan for a bicycle.

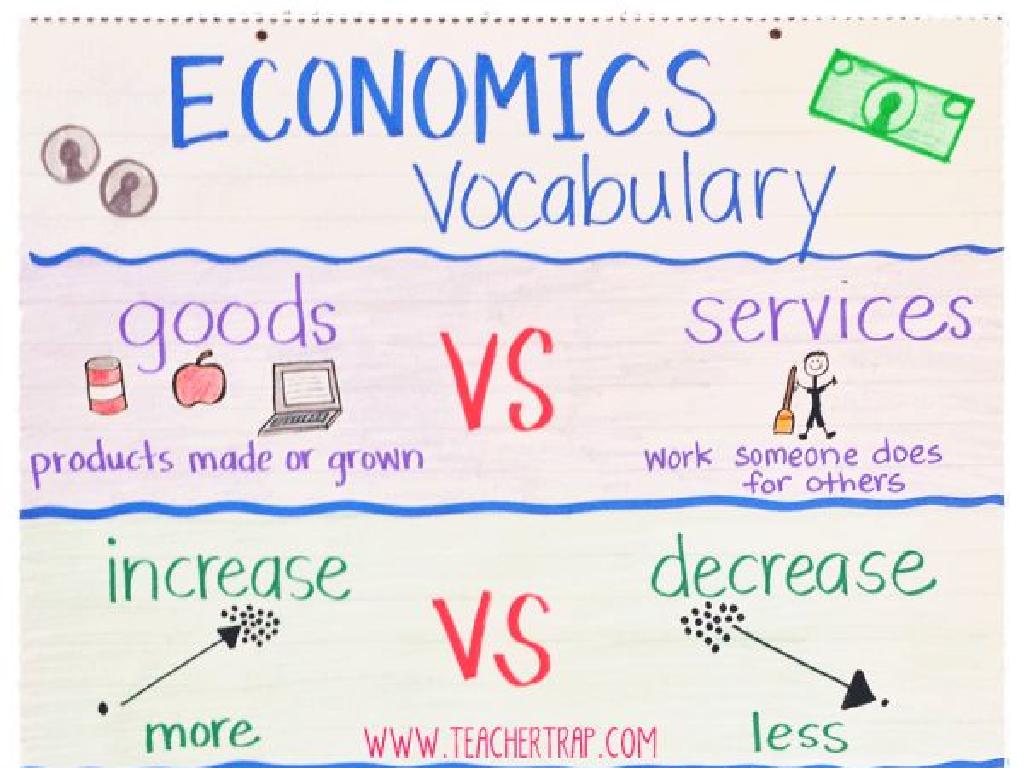

Comparing Simple and Compound Interest

– Define Compound Interest

– Interest on both initial principal and accumulated interest

– Key differences from Simple Interest

– Simple interest is calculated on principal only, while compound interest includes interest on interest

– Examples of each interest type

– Simple: Savings account. Compound: Investments.

– Understanding when to use each

– Simple for short-term, Compound for long-term growth

|

This slide aims to explain the concept of compound interest and how it differs from simple interest, which the students have already learned. Compound interest is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. It’s important to highlight that while simple interest is only calculated on the principal amount, compound interest is calculated on the principal amount plus any interest earned to date. Provide real-life scenarios where each type might be encountered, such as simple interest in a standard savings account and compound interest in investments or a mortgage. Emphasize that simple interest might be more common in short-term financial situations, whereas compound interest can lead to significant growth over the long term due to the effect of earning ‘interest on interest’.

Class Activity: Exploring Simple Interest

– Group activity: solve real-world problems

– Each group presents their findings

– Discuss the impact of interest rates

– How does changing the rate change the outcome?

– Reflect on the importance of simple interest

– Why is understanding simple interest useful in real life?

|

This activity is designed to help students apply their knowledge of simple interest in practical scenarios. Divide the class into small groups and provide each with different simple interest problems that mimic real-life situations, such as saving money in a bank account or taking out a loan. After solving the problems, each group will present their solutions and discuss how the interest rate affected the final amount of money. This will help students see the significance of interest rates in financial decisions. Encourage a class discussion on the importance of understanding simple interest when managing personal finances. Possible activities could include comparing savings accounts with different interest rates, calculating interest for a loan for a small business, or determining the cost of borrowing money for a large purchase.

Wrapping Up: Simple Interest

– Recap: What is Simple Interest?

Simple Interest formula: I = PRT (Interest = Principal x Rate x Time)

– Why learn about interest?

Understanding interest helps with smart money decisions

– Homework: Simple Interest Worksheet

Complete the provided worksheet to practice calculating interest

– Bring questions next class

|

As we conclude today’s lesson on Simple Interest, remind students of the formula I = PRT, where ‘I’ stands for the interest earned, ‘P’ is the principal amount, ‘R’ is the rate of interest per year, and ‘T’ is the time the money is invested or borrowed for. Emphasize the importance of understanding interest for making informed financial decisions in the future. For homework, students are to complete the worksheet on Simple Interest calculations to reinforce their learning. Encourage them to bring any questions they have to the next class for clarification. This will help ensure they have a solid grasp of the concept.