Balance A Budget

Subject: Math

Grade: Fifth grade

Topic: Financial Literacy

Please LOG IN to download the presentation. Access is available to registered users only.

View More Content

Introduction to Financial Literacy

– Understanding money’s role

– Money is used to buy goods and services.

– Defining financial literacy

– Financial literacy means knowing how to manage money.

– The need for financial education

– Learning about money management is crucial for future.

– Benefits of financial literacy

– It helps in making informed financial decisions.

|

This slide introduces students to the concept of financial literacy, starting with the basic understanding of money and its function in everyday life. It’s important to define financial literacy as the ability to manage and make informed decisions about personal finance. Emphasize why learning about financial literacy is essential; it equips students with the knowledge to handle money responsibly, plan for the future, and understand the consequences of financial decisions. Highlight the benefits, such as avoiding debt, saving for emergencies, and achieving financial goals. Encourage students to think about how they use money in their daily lives and the importance of making smart choices with their finances.

Understanding Budgets in Financial Literacy

– Define a budget

– A plan for how to spend money

– Importance of budgeting

– Helps us make smart money choices

– Examples of income

– Money earned from allowance or chores

– Examples of expenses

– Money spent on toys, games, or snacks

|

This slide introduces the concept of a budget to fifth-grade students, explaining it as a plan for how to spend and save money wisely. Emphasize the importance of budgeting as a tool for making informed financial decisions, which can help avoid overspending and encourage saving. Provide relatable examples of income, such as receiving an allowance or earning money from doing household chores. Similarly, discuss expenses by mentioning things they might commonly spend money on, like toys, games, or snacks. Encourage students to think about their own spending habits and how they might create a simple budget to manage their personal finances.

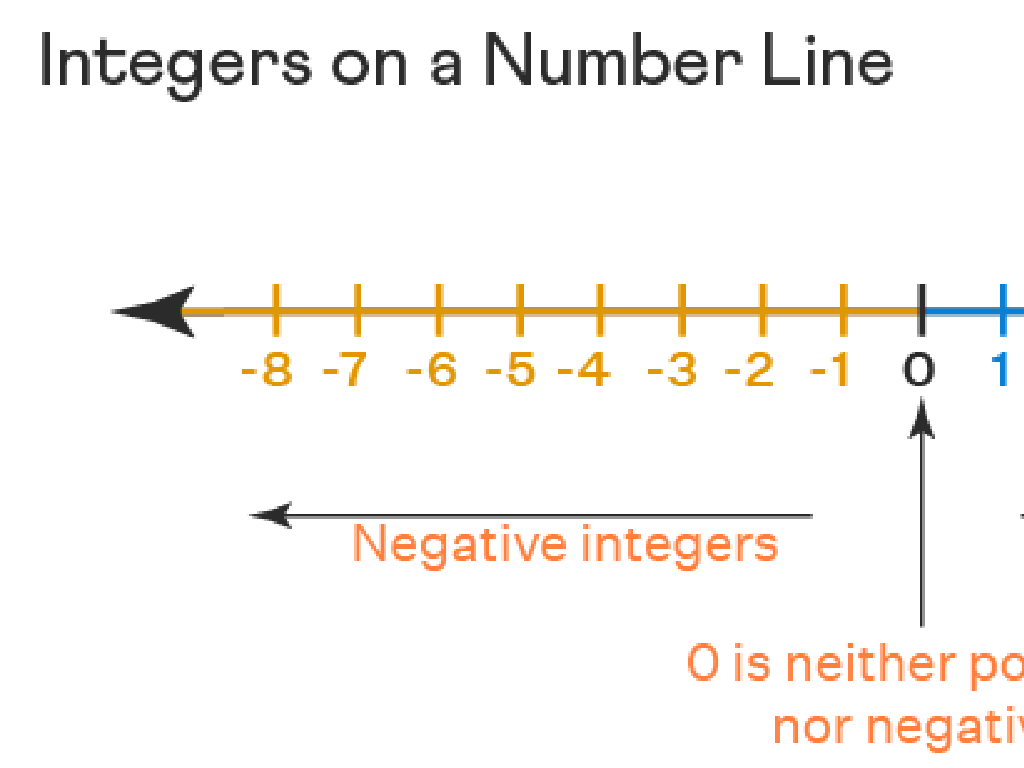

Income and Expenses: Balancing a Budget

– Understanding what is Income

– Money earned from jobs, gifts, or allowances

– Exploring types of Expenses

– Fixed: rent, utilities; Variable: food, entertainment

– Tracking Income and Expenses

– Use charts or apps to record all money earned and spent

– Importance of balancing them

|

This slide introduces the concept of income and expenses, which are the foundation of creating and maintaining a budget. Income is any money received, such as from doing chores, receiving an allowance, or gifts. Expenses are categorized into fixed (consistent costs like rent) and variable (changing costs like groceries). Students should learn how to keep track of these using simple charts, ledgers, or budgeting apps to understand where their money goes. Emphasize the importance of balancing income and expenses to avoid debt and save for future goals. Activities can include tracking a hypothetical budget or categorizing different types of expenses in a classroom discussion.

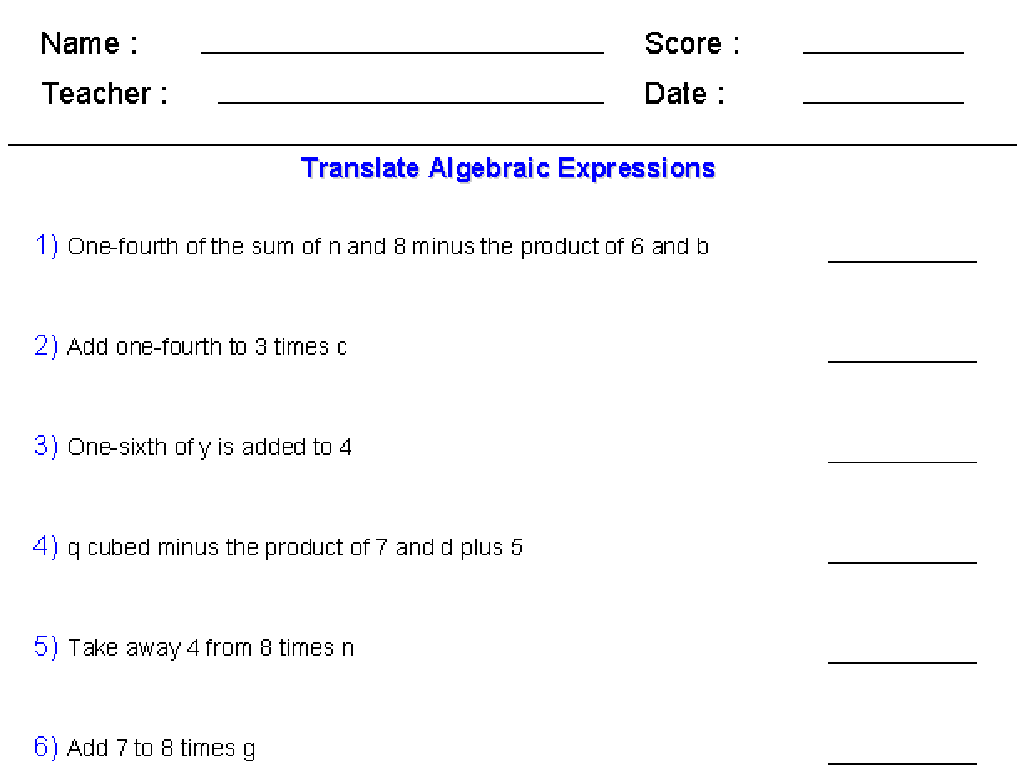

Creating a Simple Budget

– Steps to create a basic budget

– List income and expenses, then subtract to balance

– Categorize your expenses

– Sort expenses into groups like food, fun, and school

– Plan for future savings

– Set aside money from income before spending

– Balance needs and wants

|

This slide introduces students to the concept of budgeting, an essential skill for financial literacy. Start by explaining the steps to create a basic budget: listing all sources of income, detailing monthly expenses, and ensuring expenses do not exceed income. Discuss the importance of categorizing expenses to track where money is going and to make adjustments as needed. Emphasize the significance of planning for savings by setting aside a portion of income for future use, which instills the habit of saving. Lastly, teach students to differentiate between needs and wants to make informed spending decisions. Engage the class with examples relevant to their experiences, such as saving for a new toy or planning for a school event.

Balancing a Budget: Financial Literacy

– Understanding budget balance

– Balancing a budget means ensuring your spending does not exceed your earnings.

– Importance of income alignment

– It’s crucial to spend within your means to avoid debt and save for the future.

– Adjust expenses to income

– If spending is too high, find ways to reduce costs or increase your income.

– Practice budget balancing

|

This slide introduces the concept of balancing a budget, an essential skill in financial literacy. Start by explaining that a budget is a plan for how to spend money, and balancing it means not spending more than what is earned. Emphasize the importance of living within one’s means to avoid debt and to save for future goals. Discuss the need to adjust expenses, which could involve cutting back on non-essential items or finding ways to increase income through chores or small jobs. Encourage students to think about their own spending habits and how they might ensure their own budgets balance. As an activity, students can create a simple budget based on hypothetical income and expenses to practice balancing.

Making Smart Money Choices

– Understanding Needs vs. Wants

– Needs are essentials like food, Wants are extras like toys

– How to Prioritize Spending

– List expenses, decide what’s most important

– Recognizing Impulse Buying

– Buying without planning can affect savings

– Impact of Impulse on Budget

– Impulse purchases can deplete funds for needs

|

This slide aims to teach students the importance of distinguishing between needs and wants, which is a fundamental concept in financial literacy. It’s crucial for them to learn how to prioritize their spending by understanding what expenses are necessary and what can be considered as extras. Discuss the concept of impulse buying and how it can negatively impact their budget by leading to unnecessary spending. Provide examples such as buying a snack at the checkout line or a toy just because it’s on sale. Emphasize the importance of planning and thinking before buying. Activities can include role-playing scenarios where students have to choose between different spending options, or creating a simple budget based on a hypothetical allowance.

Case Study: The Smith Family Budget

– Identify the Smith’s income

– Income from jobs, investments, etc.

– List the Smith’s expenses

– Expenses like bills, groceries, and education

– Discuss ways to balance a budget

– Compare income vs. expenses, adjust spending

– Create a plan for the Smiths

|

This slide introduces students to the concept of budgeting through a relatable case study of the Smith family. Start by discussing the various sources of income a family might have, such as salaries and investments. Then, list common expenses families incur, including bills, food, and school costs. Engage the class in a discussion about the importance of balancing a budget by ensuring that expenses do not exceed income. Encourage them to think critically about ways the Smiths can adjust their spending to save money. Conclude by guiding students to create a simple budget plan for the Smith family, reinforcing the practical application of math in everyday life.

Class Activity: Plan Your Budget!

– List your income sources

– Include allowance, gifts, or chores

– Plan your expenses

– Consider savings, toys, and donations

– Balance your budget

– Income should equal expenses

– Reflect on your choices

|

This activity is designed to teach students the basics of budgeting. Provide them with a template to list their income, such as allowance or money from gifts, and their expenses, which could include savings, spending on toys, or donations. Guide them to ensure that their total income matches their total expenses, emphasizing the importance of not spending more than they have. Encourage them to think critically about their spending choices and the value of saving. Possible activities include creating a budget chart, role-playing different budget scenarios, discussing the importance of emergency funds, and reflecting on how their budgeting would work in real life.