Adjust A Budget

Subject: Math

Grade: Fifth grade

Topic: Financial Literacy

Please LOG IN to download the presentation. Access is available to registered users only.

View More Content

Introduction to Financial Literacy: Adjusting a Budget

– Learn what money and budgeting mean

– Discover why financial literacy matters

– It helps us make smart money choices

– Explore how to adjust a budget

– Find ways to save or reallocate funds

– Apply budgeting skills in activities

– We’ll practice with real-life scenarios

|

This slide introduces students to the concept of financial literacy with a focus on understanding money and the basics of budgeting. Emphasize the importance of financial literacy in making informed decisions about spending and saving. Explain that adjusting a budget means reviewing and modifying it to better meet financial goals, such as saving for a new toy or a school trip. Activities will include real-life scenarios where students will practice adjusting a budget, such as planning a birthday party with a fixed amount of money. Encourage students to think about their own spending habits and how they might need to adjust their personal budgets in the future.

Understanding Budgets in Financial Literacy

– What is a budget?

– A plan for how to spend money

– Income versus Expenses

– Money earned (income) and money spent (expenses)

– The goal of budgeting

– To manage money and plan for future needs

– Making smart money choices

|

This slide introduces the concept of a budget to fifth-grade students, which is a fundamental aspect of financial literacy. A budget is essentially a plan that helps people decide how to spend their money wisely. It involves understanding the difference between income (money received, such as allowances) and expenses (money spent on goods and services). The purpose of having a budget is to ensure that expenses do not exceed income and to set aside money for savings or future needs. Encourage students to think about their own experiences with money, such as their allowance or money received as gifts, and how they decide to use it. Discuss the importance of making smart choices with money, such as saving for a desired toy or game, which will help them understand the value of budgeting in everyday life.

Creating a Basic Budget

– Steps to create a simple budget

– Identify your income sources

– Money from allowance, gifts, or chores

– List all your expenses

– Include items like toys, snacks, and savings

– Calculate income minus expenses

– This shows if you have extra money or need to cut back

|

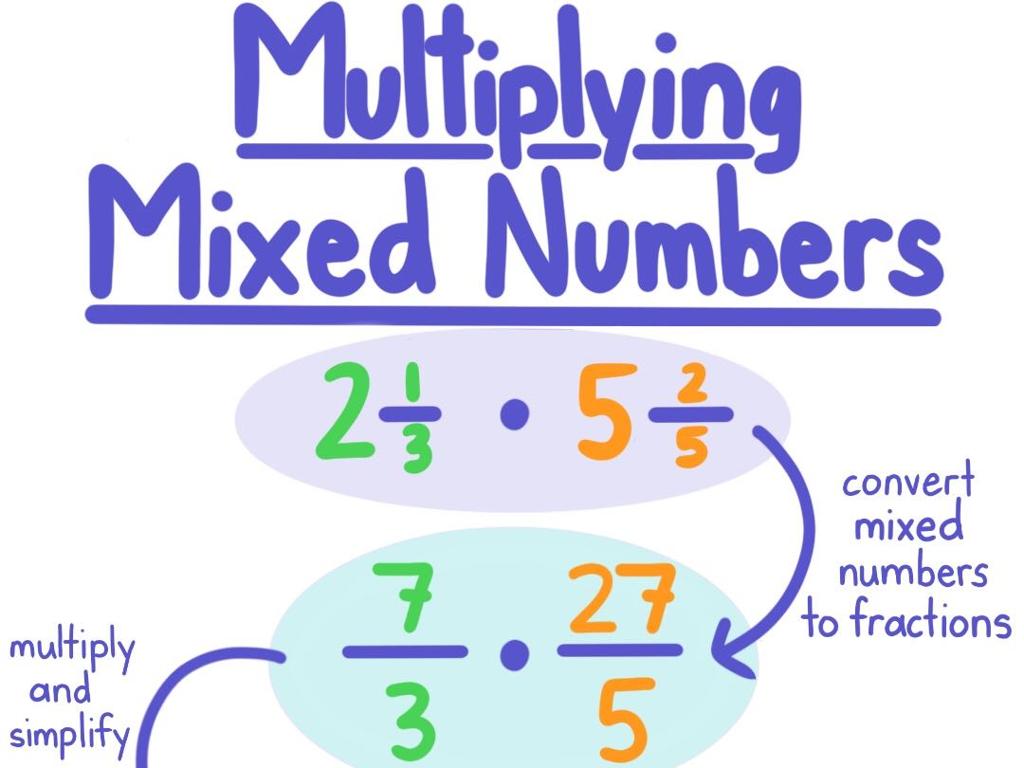

This slide introduces students to the concept of budgeting, an essential skill for financial literacy. Begin by explaining the steps to create a simple budget. Emphasize the importance of knowing where money comes from, such as allowances or birthday money. Then, guide students to list common expenses they might have, like buying toys or saving for a special item. Finally, teach them to calculate the difference between their income and expenses to understand if they’re spending within their means. This exercise will help them learn to manage money responsibly and plan for future financial stability. Encourage students to think about their own income and expenses and how they might adjust their spending habits.

Adjusting Your Budget

– Why adjust a budget?

– To reflect changes in income or goals

– Ways to boost savings

– Set savings goals, use piggy banks or savings apps

– Identify unnecessary expenses

– Review spending, find patterns, and decide what can be reduced or removed

– Strategies for budget adjustments

– Prioritize spending, use tools like budgeting apps or charts

|

This slide introduces the concept of budget adjustment to fifth graders. Start by discussing the reasons one might need to adjust a budget, such as a change in income or new financial goals. Teach students simple ways to increase their savings, like setting aside a portion of their allowance. Guide them to understand how to identify and cut unnecessary expenses by reviewing their spending habits. Finally, provide strategies for making these adjustments, emphasizing the importance of prioritizing needs over wants and using tools to track their budget. Encourage students to think of this as a way to make sure they can always afford the things they need and save for the things they want.

Case Study: Adjusting Jane’s Budget

– Meet Jane and her budget

– Jane is a student who earns and spends monthly.

– Review initial budget setup

– Look at Jane’s income and expenses list.

– Spot areas to adjust spending

– Find categories where Jane can save more.

– Discuss importance of budgeting

|

Introduce the class to Jane, a fictional character, to help students understand budgeting in a relatable context. Present Jane’s initial budget, including her income and expenses, and engage the students in a discussion about where she might be overspending. Encourage them to think critically about which areas of her budget could be adjusted to save money. Emphasize the importance of budgeting as a skill for managing finances effectively. This exercise will help students apply mathematical concepts to real-life scenarios and understand the value of financial literacy.

Class Activity: Let’s Adjust a Budget!

– Work in groups on a budget

– Analyze the provided budget

– Look at income and expenses

– Make adjustments to save money

– Find areas to cut costs or increase savings

– Present your budget to the class

|

This interactive class activity is designed to teach students the practical skills of budgeting. Divide the class into small groups and provide each group with a sample budget. The budget should include various income sources and expenses such as groceries, utilities, and entertainment. Instruct the students to analyze the budget and identify areas where they can make adjustments to either decrease expenses or increase savings. Encourage creativity and critical thinking. After the activity, each group will present their adjusted budget to the class, explaining their decisions and the reasoning behind them. This will foster public speaking skills and financial literacy. Possible variations of the activity could include adjusting a budget for a family event, planning for unexpected expenses, or finding ways to allocate funds for a savings goal.

Conclusion: The Power of Budgeting

– Recap budget adjustments

– Importance of budget skills

– Adjusting a budget helps us manage money and achieve goals.

– Reflect on today’s learning

– Think about how budgeting can help you save for something special.

– Share your budget insights

– Discuss what you found interesting or useful about budgeting.

|

As we wrap up today’s lesson on adjusting a budget, it’s important to review the key points we’ve covered. Emphasize the significance of budgeting as a critical life skill that enables individuals to plan for their financial future and make informed spending decisions. Encourage students to reflect on what they’ve learned about budgeting and how it can apply to their own lives, such as saving for a new toy or planning for a family trip. Invite them to share their thoughts and insights on the topic, fostering a classroom environment where students can learn from each other’s perspectives on financial responsibility.