Compare Savings Options

Subject: Math

Grade: Fourth grade

Topic: Financial Literacy

Please LOG IN to download the presentation. Access is available to registered users only.

View More Content

Financial Literacy: Saving Money

– What is money and savings?

– Reasons to save money

– Saving helps in emergencies, for big purchases, and future goals.

– Various savings methods

– Piggy banks, savings accounts, and bonds.

– Choosing the best savings option

– Compare safety, growth, and how soon you can use your money.

|

This slide introduces students to the concept of financial literacy with a focus on understanding money and the importance of saving. Begin by explaining what money is and the concept of saving for future needs. Discuss the reasons why saving money is important, such as for emergencies, large purchases, or future goals like college. Introduce different methods of saving, including piggy banks for immediate access, savings accounts for security and a little interest, and bonds for long-term growth. Encourage students to think about how each option fits different saving goals. The slide aims to help students understand that different savings options are suitable for different purposes and that it’s important to make informed decisions about where to save their money.

Understanding Savings

– What does saving mean?

– Keeping money aside for later

– Saving is like growing a plant

– Just as a seed slowly grows into a plant, your money can grow over time.

– Where can we save money?

– Piggy banks, savings accounts at banks

– Why is saving important?

|

This slide introduces the concept of saving money to fourth-grade students. Begin by explaining that saving is when you don’t spend all your money right away, but keep some for the future. Relate the idea of saving to something they can understand, like planting a seed in the ground and caring for it until it grows into a big plant; similarly, money saved and put aside can ‘grow’ over time. Provide examples of saving methods suitable for their age, such as piggy banks for small amounts or savings accounts for larger amounts. Emphasize the importance of saving for future needs or goals, like buying a new toy or saving for college. Encourage students to think about their own savings goals and how they might start saving money.

Comparing Savings Options

– Piggy banks: A first step to save

– Easy way to start saving with coins and bills

– Savings accounts: Earn interest

– Money saved in banks grows over time with interest

– Bonds and CDs: Long-term benefits

– Invest for the future; they pay more the longer you save

– Choosing the best saving option

|

This slide introduces students to different ways to save money, each with its own advantages. Piggy banks are a tangible way for kids to begin learning about saving. Savings accounts in banks offer the benefit of earning interest, making the money grow. Bonds and Certificates of Deposit (CDs) are long-term savings options that typically offer higher interest rates over an extended period. Encourage students to think about their own savings goals and which option might suit them best. Discuss the concept of interest and how it can help money increase over time. This will help them understand the value of saving and how different options can be beneficial for different purposes.

Comparing Savings Options

– Understanding the safety of savings

– Is your money protected in the bank?

– Exploring interest on savings

– Interest is extra money the bank pays you.

– Checking accessibility of your money

– Can you get your money easily when you need it?

– Making smart savings choices

|

This slide aims to teach students about the important factors to consider when comparing different savings options. Discuss the concept of safety in terms of how banks protect their money through federal insurance. Explain how interest works as a reward for keeping money in the bank and how it can grow over time. Explore accessibility, emphasizing the importance of being able to use money when it’s needed, and how some savings accounts may have restrictions. Encourage students to think about these factors when saving money to make informed decisions that align with their goals and needs.

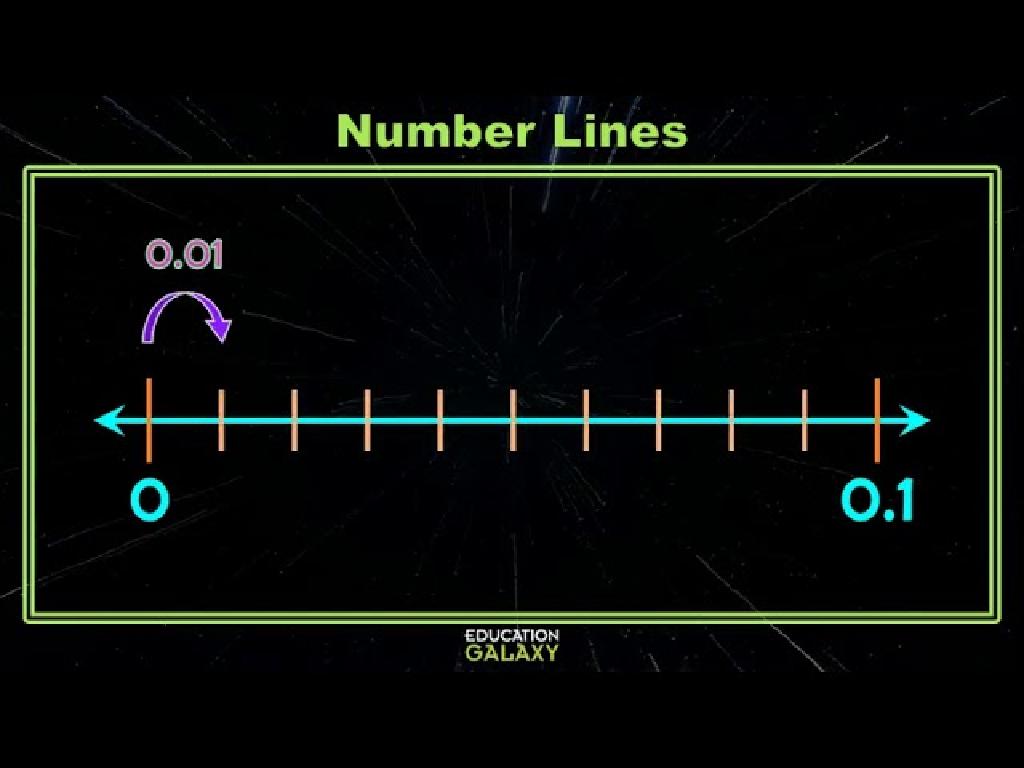

Why Interest Matters in Saving

– Interest: A reward for saving

– Save more, earn more interest

– Understanding Compound Interest

– Interest earned on both the initial amount and on the earned interest.

– The power of earning on earnings

– Compound interest can significantly increase savings over time.

|

This slide aims to explain the concept of interest to fourth-grade students and why it is beneficial when saving money. Interest can be thought of as a ‘thank you’ from the bank for keeping your money with them, and it allows your savings to grow over time. The more money you save, the more interest you can earn. Compound interest is particularly powerful because it means you earn interest not just on your original savings, but also on the interest that money has already earned. This can lead to much larger savings growth over time, which is an important concept for students to understand as they begin to learn about financial responsibility and planning for the future.

Making Smart Choices: Saving for the Future

– Set your saving goals

– Think about what you want to save for, like a new bike or a college fund.

– Pick the best saving option

– Compare piggy banks, savings accounts, or family plans.

– Saving options can change

– What’s best now might not be later, like moving from a piggy bank to a bank account.

– Review your choices regularly

– Check if your saving method is still the best every once in a while.

|

This slide is aimed at teaching students the importance of setting personal saving goals and understanding that different saving options are available depending on their needs. It’s crucial to convey that the best saving option can change as they grow older or as their goals evolve. For example, a piggy bank might be a good start for younger children, but a savings account could be more beneficial as they get older. Encourage students to think about what they want to save for and to review their saving strategies periodically to ensure they are making the most of their money. Use examples relevant to their age, such as saving for a toy, a school trip, or future education.

Class Activity: Build Your Savings Plan

– Create your personal savings plan

– Set a savings goal for yourself

– Think of something you really want to buy

– Choose the best option to save

– Piggy bank, savings account, or under the mattress?

– Present your plan to classmates

|

This activity is designed to help students understand the concept of saving money and the different options available for saving. Students will think of a personal goal, like saving for a new toy or a book, and then decide how they will save their money. They can choose from a piggy bank, a savings account, or even hiding it in a safe place at home. Once they have created their plan, they will present it to the class to practice their public speaking skills and to share their ideas with peers. As a teacher, provide guidance on different savings options and their benefits. Encourage creativity and praise their decision-making process. Possible activities could include role-playing different savings scenarios, creating posters of their savings plan, or even starting a class savings challenge.