Banking

Subject: Life skills

Grade: High school

Topic: Financial Literacy

Please LOG IN to download the presentation. Access is available to registered users only.

View More Content

Introduction to Banking

– Role of banks in financial literacy

– Banks are pivotal in managing money, saving, and investing.

– Overview of today’s banking lesson

– Banking’s impact on financial future

– Knowledge of banking can lead to better financial decisions and security.

– Importance of being bank-literate

– Understanding banking is crucial for personal financial management.

|

This slide introduces students to the concept of banking within the broader context of financial literacy. It aims to explain the role of banks in everyday financial activities such as saving, investing, and managing money. The overview of today’s lesson will cover the basics of banking operations, types of accounts, and the importance of banking services. Emphasize how banking knowledge is essential for making informed financial decisions that can secure a stable financial future. Encourage students to think about how being bank-literate can empower them to take control of their personal finances and set the foundation for their economic well-being.

Types of Bank Accounts

– Checking Accounts for daily use

– Accessible for daily transactions like bill payments.

– Savings Accounts for future goals

– Ideal for setting aside money with interest for long-term objectives.

– Certificates of Deposit (CDs) for investing

– Lock funds for a fixed term to earn higher interest than savings.

– Money Market Accounts for higher interest

– Offers higher interest rates with limited transaction capabilities.

|

This slide aims to educate high school students on the various types of bank accounts and their purposes. Checking accounts are designed for frequent access and everyday money management, such as depositing paychecks and paying bills. Savings accounts are meant for storing money over a longer period, often with interest accumulation, suitable for future financial goals like college funds or emergency reserves. CDs are time-bound investments that typically offer higher interest rates in exchange for the commitment to leave the money untouched for a set period. Money Market Accounts combine the benefits of savings accounts with the potential for higher interest rates, though they may require a higher minimum balance and limit the number of transactions. Encourage students to think about their current financial goals and which type of account could best serve their needs.

How to Open a Bank Account

– Documents required for a new account

– Typically need ID, proof of address, and SSN.

– Comprehend terms and conditions

– Read and understand fees, rates, and account rules.

– Steps to set up your bank account

– Application, verification, initial deposit, and account usage.

|

This slide aims to guide high school students through the process of opening their first bank account, a crucial step in financial literacy. Start by discussing the common documents required by most banks, such as a government-issued ID, proof of address, and Social Security Number. Emphasize the importance of understanding the terms and conditions associated with an account, including any fees, interest rates, and rules for minimum balances or direct deposits. Outline the typical steps involved in setting up an account: completing an application, going through a verification process, making an initial deposit, and then being able to use the account. Encourage students to research different banks and their offerings to find the best fit for their financial needs.

Essential Banking Services

– ATMs and Debit Cards usage

– Withdraw cash or check balance anytime, anywhere.

– Online and Mobile Banking benefits

– Conveniently manage accounts from your devices.

– Understanding Loans and Credit

– Loans and credit lines can finance major purchases.

– Responsible Borrowing practices

– Learn to borrow wisely to avoid debt traps.

|

This slide aims to introduce students to the fundamental banking services that they will encounter in their daily lives. ATMs and debit cards provide quick access to funds and account information. Online and mobile banking platforms offer a convenient way to manage finances on the go, allowing users to transfer money, pay bills, and monitor account activity. Understanding loans and credit is crucial for making informed decisions about borrowing money, whether for education, a car, or a home. It’s important to emphasize responsible borrowing practices, such as understanding interest rates, repayment terms, and the consequences of defaulting on loans. Encourage students to ask questions and share any personal experiences or knowledge they have regarding these banking services.

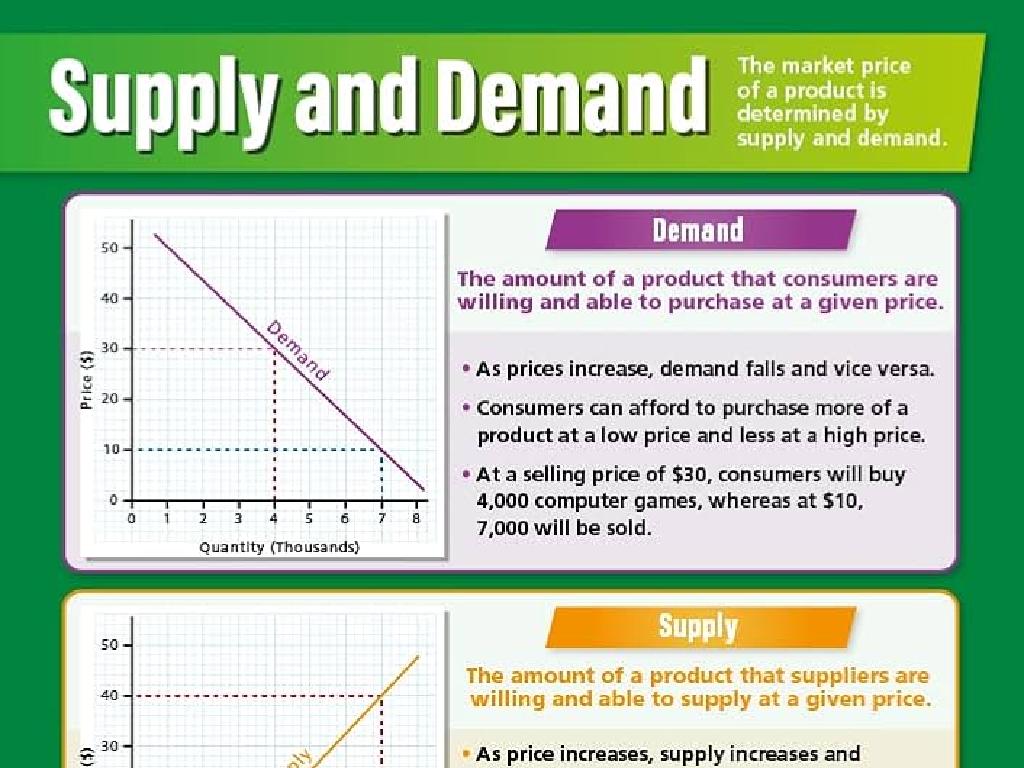

Interest Rates and Fees in Banking

– Understanding interest rates

– Interest: money earned or paid for using money. E.g., savings account interest vs. loan interest.

– Types of banking fees

– Monthly maintenance, ATM, overdraft, and minimum balance fees are common.

– Strategies to avoid fees

– Use in-network ATMs, maintain minimum balances, and monitor your account to avoid overdraft.

– Impact of rates and fees on savings

– High fees can negate interest earnings. It’s crucial to choose accounts with low fees.

|

This slide aims to educate high school students on the fundamentals of interest rates and the various fees associated with banking. Interest rates are a critical concept, as they affect how much money one can earn on savings or owe on loans. It’s important to explain how compounding interest works and how it can impact savings over time. Discuss the common types of fees that banks charge, such as monthly maintenance and ATM fees, and provide practical tips on how to avoid them, like maintaining minimum balances and using in-network ATMs. Highlight the importance of being aware of these factors when choosing a bank or financial product, as they can significantly affect one’s financial health. Encourage students to research and compare different banking options to find the most cost-effective solutions.

Budgeting and Managing Your Bank Accounts

– Crafting a personal budget

– List income and expenses to track cash flow

– Monitoring bank accounts regularly

– Check account activity to spot errors or fraud

– Setting up account alerts

– Use bank’s notification features for real-time updates

– Implementing safeguards for security

– Create strong passwords and enable two-factor authentication

|

This slide aims to educate high school students on the fundamentals of financial literacy, particularly in the context of banking. Students should understand the importance of creating a personal budget as a tool to manage their finances effectively, ensuring they track their income and expenses to avoid overspending. Regular monitoring of bank accounts is crucial for early detection of any unauthorized transactions or errors. Encourage students to utilize their bank’s alert systems to stay informed about account activities. Discuss the significance of online security measures such as strong passwords and two-factor authentication to protect their financial information. Provide examples of budgeting apps or templates they can use to simplify the process. The goal is to empower students with the knowledge to manage their bank accounts responsibly.

Safety and Security in Banking

– Protect your personal information

– Never share passwords or PINs, and be cautious online.

– Learn about FDIC insurance

– FDIC insures deposits up to $250,000 per account type per bank.

– Steps to take if fraud occurs

– Contact your bank immediately and monitor your accounts.

– Preventing theft and fraud

– Use secure networks, update passwords regularly, and review statements.

|

This slide aims to educate students on the importance of safety and security while managing their bank accounts. Discuss the significance of protecting personal information, such as social security numbers, bank account details, and online login credentials. Explain the role of the Federal Deposit Insurance Corporation (FDIC) in protecting deposits. Emphasize immediate actions to take when they suspect fraud, including contacting their bank and monitoring account activity. Lastly, provide tips on how to prevent theft and fraud, such as using secure networks for banking, changing passwords regularly, and thoroughly reviewing bank statements for any unauthorized transactions. Encourage students to ask questions and share their thoughts on the topic.

Class Activity: Budgeting Workshop

– Create a mock monthly budget

– Learn to minimize fees

– Avoid unnecessary bank fees by choosing the right account and monitoring your spending.

– Maximize interest earnings

– Explore high-interest savings accounts and certificates of deposit (CDs).

– Discuss smart financial choices

– Weigh the pros and cons of spending, saving, and investing.

|

This interactive workshop is designed to give students hands-on experience with personal budgeting. Provide each student with a mock bank account balance and a list of typical monthly expenses. Guide them through the process of allocating funds to each expense category, emphasizing the importance of savings and emergency funds. Discuss how to avoid common bank fees, such as overdraft charges, and the benefits of accounts that yield higher interest. Encourage students to think critically about their spending habits and the long-term impact of their financial decisions. Possible activities include comparing different bank account types, simulating an investment scenario, or creating a plan to achieve a financial goal.