Financial Institution Vocabulary

Subject: Math

Grade: Fourth grade

Topic: Financial Literacy

Please LOG IN to download the presentation. Access is available to registered users only.

View More Content

Financial Literacy: Banks & Money

– What is Financial Literacy?

– It’s knowing how to manage money effectively.

– Why is learning about money important?

– Helps us make smart money choices.

– Today’s goal: Key Financial Terms

– Learn words like ‘bank’, ‘account’, ‘deposit’.

– Understanding Financial Institutions

– Banks are places that keep our money safe.

|

This slide introduces students to the concept of financial literacy, emphasizing the importance of understanding money and how financial institutions like banks operate. Start by explaining financial literacy as the ability to manage money wisely. Discuss why it’s crucial to learn about money, such as making informed decisions about saving and spending. Introduce the goal of the day, which is to familiarize students with key vocabulary related to financial institutions. Explain what financial institutions are and their role in handling money. Use examples that are relatable to fourth graders, such as saving their allowance in a piggy bank versus a real bank. Encourage questions to ensure understanding.

Exploring Financial Institutions

– What is a Financial Institution?

– A place where we can save money, get loans, and more.

– Types: Banks, Credit Unions, Online Banks

– Traditional banks, member-owned credit unions, and internet-based banks.

– Main functions they serve

– They keep our money safe, lend us money, and exchange different currencies.

– How they help us with money

|

This slide introduces students to the concept of financial institutions and their role in our daily lives. Begin by defining a financial institution as an organization that deals with monetary transactions such as deposits, loans, and currency exchanges. Discuss the different types of financial institutions, including traditional banks, credit unions, and online banks, highlighting the unique features of each. Explain the main functions, emphasizing how they help people manage their money by providing a safe place to save, offering loans for various needs, and facilitating currency exchange for international transactions. Use examples that are relatable to fourth graders, such as saving their allowance in a piggy bank versus a savings account at a bank. Encourage questions to ensure understanding.

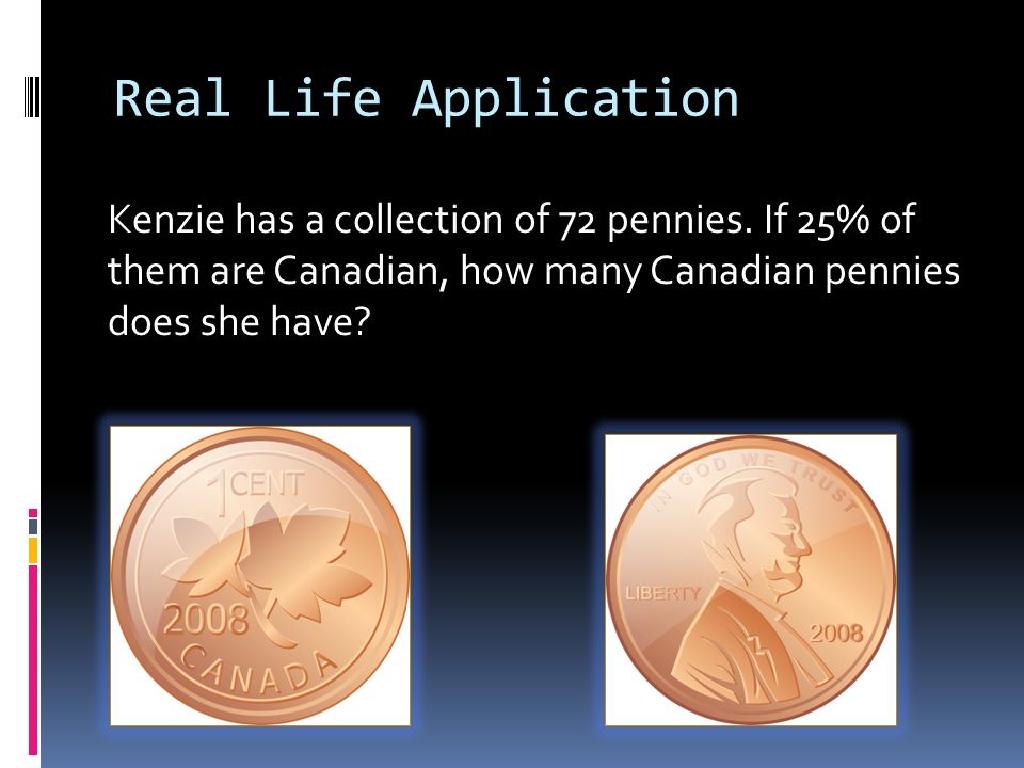

Key Vocabulary – Part 1: Bank Basics

– What is a Bank Account?

– A bank account keeps your money safe.

– Making a Deposit

– Deposit means adding money to your account.

– Understanding Withdrawals

– Withdrawal means taking money out.

|

This slide introduces students to basic financial institution vocabulary, focusing on the concepts of bank accounts, deposits, and withdrawals. Start by explaining that a bank account is like a special container at a bank where money can be kept safely. When you put money into this container, it’s called a deposit. When you take money out, it’s called a withdrawal. Use relatable examples, such as saving money from a weekly allowance or spending money on a toy, to illustrate these terms. Encourage students to think of questions about bank accounts, deposits, and withdrawals to discuss in the next class.

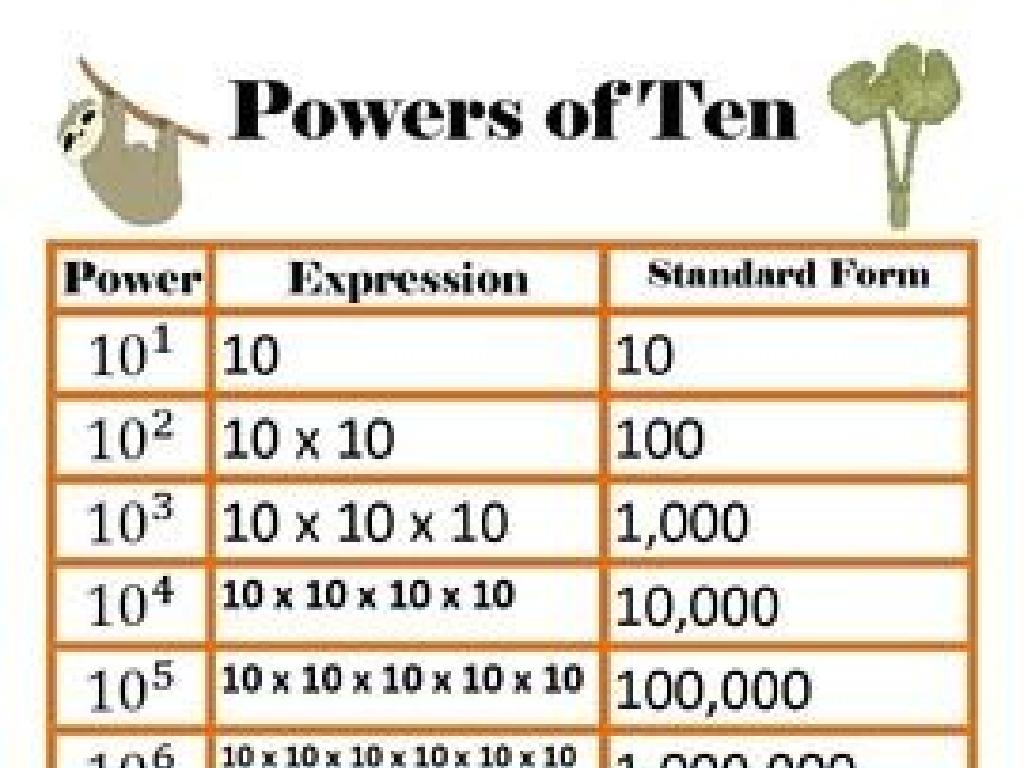

Key Vocabulary – Part 2: Understanding Money

– Interest: Earning extra money

– It’s like a bonus for saving your money in the bank!

– Loan: Borrowing money from a bank

– It’s like getting money now, but you promise to pay back more later.

– Savings: Setting money aside

– It’s your personal stash for future toys or emergencies!

– How banks help with money

|

This slide introduces students to basic financial concepts that are essential for understanding how banks and money work. Interest is explained as the extra money one can earn by keeping money in a bank or the extra money one has to pay when borrowing money from the bank. A loan is described as money borrowed that comes with the responsibility of paying it back with a little extra (interest). Savings are portrayed as money that is put away safely for buying something big in the future or for unexpected needs. Use examples relatable to fourth graders, such as saving up for a new bike or borrowing money for a school project, to illustrate these concepts. Encourage students to ask questions and share their own experiences with saving or borrowing money, even if it’s in a simple form like a piggy bank or borrowing from family.

Understanding Financial Vocabulary

– What are deposits and withdrawals?

– Deposits add money to accounts; withdrawals take money out.

– How does interest work?

– Interest is money earned or paid for using money.

– The role of interest in savings

– Interest on savings grows your money over time.

– Why saving money is important

– Saving helps you buy big things and prepares for emergencies.

|

This slide aims to introduce students to basic financial concepts that are essential for understanding how money works within financial institutions. Start by explaining deposits and withdrawals with simple examples, such as depositing a birthday check or withdrawing money to buy a toy. Clarify the concept of interest by comparing it to a small reward for saving money or a fee for borrowing money. Emphasize the benefit of earning interest on savings to illustrate how money can grow over time. Finally, engage the class in a discussion about the importance of saving money, highlighting goals like purchasing a desired item or ensuring financial security in case of unexpected expenses. Encourage students to share their own experiences or goals related to saving money.

Financial Institution Services

– ATM: Quick cash access

– ATM stands for Automated Teller Machine, a tool to withdraw cash using a bank card.

– Credit Card: Borrow for purchases

– A credit card lets you borrow money from the bank to buy things and pay back later.

– Online Banking: Manage money online

– Online banking allows you to check balances, transfer money, and pay bills via the internet.

|

This slide introduces students to basic services provided by financial institutions. An ATM is a machine that allows people to take out cash from their bank accounts using a special card. A credit card is a plastic card issued by a bank that lets you buy things now and pay for them later. Online banking is a service that lets you handle your banking activities through the internet, such as checking your account balance or paying bills. It’s important to explain that while these services offer convenience, they also come with responsibilities like keeping track of your spending and protecting your personal information.

Class Activity: Bank Role Play

– Split into groups: Tellers and Customers

– Practice making deposits and withdrawals

– Calculate interest on savings

– Use simple interest formula for calculations

– Discuss the role of a bank

– Why do people use banks?

|

This interactive class activity is designed to help students understand the basic functions of a bank through role-playing. Divide the class into two groups: one will act as bank tellers and the other as customers. Tellers will assist customers in making deposits and withdrawals, ensuring they fill out the appropriate forms. Then, guide students on how to calculate interest on savings using a simple interest formula (Interest = Principal x Rate x Time). This will help them understand how money can grow over time in a savings account. Finally, lead a discussion on why banks are essential in our daily lives, such as keeping money safe and helping to save for the future. Provide the teacher with 4-5 different scenarios for deposits, withdrawals, and interest calculations to cater to different student groups.

Financial Vocabulary Review

– Recap key financial terms

– Importance of financial vocabulary

– Understanding these terms helps with managing money wisely.

– Open floor for questions

– Encourage curiosity and participation

– Asking questions helps clarify and solidify knowledge.

|

This slide aims to consolidate the students’ understanding of financial institution vocabulary. Begin with a quick recap of the key terms discussed in previous lessons, such as ‘bank’, ‘credit union’, ‘loan’, and ‘interest’. Emphasize the importance of these terms in everyday life, such as saving money or planning for big purchases. Open the floor to student questions, encouraging them to ask about any term or concept they are unsure about. This interactive session will help address any uncertainties and reinforce their learning. It’s also an opportunity to foster a curious mindset towards financial literacy, which is crucial for their future personal finance management.

Financial Vocabulary Homework

– Complete the Vocabulary Worksheet

– Visit a bank with your parents

– Notice the different areas and what they do

– Observe and learn at the bank

– Look for ATMs, tellers, and how people deposit money

– Write down three new learnings

|

This homework assignment is designed to reinforce the financial vocabulary learned in class and provide a practical experience by visiting a bank. The worksheet will help students review and understand key terms. Visiting a bank will give them a chance to see how financial institutions operate in real life. Encourage students to take note of the roles of bank employees, the process of transactions, and the environment. After the visit, they should reflect on their experience and write down three things they learned. This could include new vocabulary, observations about bank operations, or interactions between customers and bank staff. This activity will help solidify their understanding of financial institutions and prepare them for future financial literacy topics.